In the aftermath of a motorcycle accident in Pasco County, FL, dealing with insurance companies can be a daunting task. As you grapple with the physical and emotional aftermath, it’s crucial to understand the process and requirements involved in handling insurance claims. This guide aims to provide you with insights on how to navigate the intricate landscape of dealing with insurance companies after a motorcycle accident in Pasco County, FL.

Understanding Your Insurance Coverage

The first step in handling insurance companies after a motorcycle accident is to thoroughly understand your insurance coverage. In Florida, the “no-fault” insurance system requires all motorists to carry Personal Injury Protection (PIP) insurance. This coverage can help with immediate medical expenses and lost wages, regardless of who was at fault in the accident. However, PIP might not cover all your costs, especially if the injuries are severe.

Additionally, if you opted for optional coverage such as Medical Payments (MedPay) or Uninsured/Underinsured Motorist coverage, these can come into play depending on the circumstances of the accident. Familiarize yourself with your policy details to ensure you know what is covered and what isn’t.

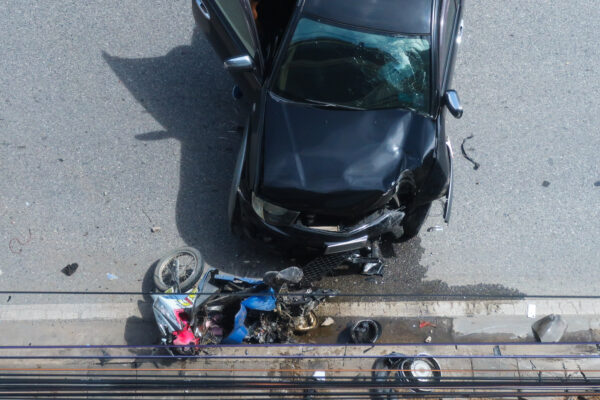

Documenting the Accident Scene

After a motorcycle accident, it is crucial to gather as much evidence as possible. Document the scene by taking photographs of the vehicles involved, any visible injuries, road conditions, and traffic signs. This visual documentation can serve as valuable evidence when dealing with insurance companies. If there were any witnesses, obtain their contact information, as their statements can provide additional support for your claim.

Seeking Prompt Medical Attention

Your health should be your top priority after a motorcycle accident. Even if your injuries seem minor initially, it’s essential to seek prompt medical attention. Delaying medical care can not only exacerbate injuries but may also weaken your claim with the insurance company. Medical records and reports from healthcare professionals play a crucial role in establishing the extent of your injuries and the associated medical expenses.

Notifying Your Insurance Company

As soon as possible after the accident, notify your insurance company about the incident. Be factual and concise in your description of the events, providing essential details without admitting fault. Insurance companies often require prompt reporting, and failure to do so may jeopardize your claim.

Dealing with the Other Party’s Insurance Company

If the motorcycle accident was caused by another party, you will likely need to communicate with their insurance company. It’s important to remember that the interests of the other party’s insurer may not align with yours. Avoid providing recorded statements without consulting legal representation, as these statements can be used against you in the claims process.

Gathering and Organizing Documents

To strengthen your insurance claim, gather and organize all relevant documents. This includes the police report, medical bills, records of lost wages, repair estimates for your motorcycle, and any correspondence with the insurance companies. Having a well-documented file can streamline the claims process and help ensure you receive fair compensation.

Understanding Florida’s Comparative Negligence Law

Florida operates under a comparative negligence system, meaning that compensation may be reduced based on your degree of fault in the accident. Insurance adjusters often use this principle to minimize payouts. To protect your interests, it’s advisable to consult with a legal professional who can navigate the complexities of comparative negligence and advocate for your rights.

Resisting Early Settlement Offers

Insurance companies may present early settlement offers in an attempt to close the case quickly. It’s essential to approach such offers with caution, as they may not fully account for the long-term costs associated with your injuries. Before accepting any settlement, consult with an attorney to assess the fairness of the offer and ensure it adequately covers your current and future expenses

Facing Insurance Company Challenges

Dealing with insurance companies can be challenging, especially when they attempt to minimize your claim or dispute liability. Insurance adjusters may use various tactics to protect their interests, such as questioning the extent of your injuries or suggesting pre-existing conditions. Having legal representation can be invaluable in countering these challenges and ensuring you receive fair compensation.

The Role of Legal Representation

In complex cases involving motorcycle accidents, seeking legal representation is often advisable. An experienced attorney can navigate the intricacies of insurance laws, negotiate with insurance companies on your behalf, and, if necessary, pursue legal action. Legal professionals understand the nuances of personal injury claims and can help you build a robust case to maximize your chances of a favorable outcome.

Handling insurance companies after a motorcycle accident in Pasco County, FL, requires a strategic and informed approach. By understanding your insurance coverage, documenting the accident scene, seeking prompt medical attention, and consulting with legal representation, you can navigate the claims process more effectively. Remember that your well-being and financial recovery are the top priorities, and advocating for your rights is crucial in securing the compensation you deserve.

If you find yourself grappling with the aftermath of a motorcycle accident in Pasco County, FL, don’t hesitate to seek legal guidance. Contact us at Serrano Law today for a consultation, and let us help you navigate the complexities of dealing with insurance companies and securing the compensation you need to move forward.